prince william county real estate tax payments

How old is holly wheeler in real life wordpress releases. There are several convenient ways property owners may make payments.

Press 1 to pay Personal Property Tax.

. Enter your payment card information. At 930 pm the county announced its online. Enter the Account Number listed on the billing statement.

Those who waited until the last minute to pay their personal property taxes in Prince William County encountered problems. The real estate tax rate for the 2019 tax year is 120 per 100. The County bills and collects tax payments directly from these companies.

When tax assessors estimate the value of your property they multiply that number by the tax rate of the county. Property taxes in Prince William County are due on June 5th and are paid to the Commissioner of the Revenue. Prince William County real estate taxes for the first half of 2020 are due on July 15 2020.

Best car leasing deals 2022. Prince William County collects on average 09 of a propertys assessed fair market value as property tax. Manage Access - Grant Revoke.

Most homeowners pay their real estate taxes through a mortgage services company. All you need is your tax account number and your checkbook or credit card. Welcome to Prince William Countys Taxpayer Portal.

Finding the Amount of Property Taxes Paid. When are property taxes due in Virginia County Prince William. A convenience fee is added to payments by credit or debit card.

Press 2 to pay Real Estate Tax. Payment of the Personal Property Tax is normally due each year by October 5 see Tax Bill for due date. Access to Other Accounts.

Then they get the assessed value by multiplying the. Business tangible and personal property taxes were October 6th. Differential and integral calculus by feliciano and uy pdf free lawton station bluffton sc amenities.

Payment by e-check is a free service. The second and all subsequent installments are due on the 5th of each month. If payment is late a 10 late.

Whether you are already a resident or just considering moving to Prince William County to live or invest in real estate estimate local. By creating an account you will have access to balance and account information notifications etc. Hi the county assesses a land value and an improvements value to get a total value.

Tax Relief for the Elderly and Disabled Contact the Real Estate. The median property tax in Prince William County Virginia is 3402 per year for a home worth the median value of 377700. Learn all about Prince William County real estate tax.

PERSONAL PROPERTY TAX PAYMENT AND PENALTY. The system will verbally. You can pay a bill without logging in using this screen.

How property tax calculated in pwc. Prince William County has one of the highest median property taxes in the United. The first monthly installment is due July 15th.

What is different for each county and state is the property tax rate. Prince William County collects on average 09 of a propertys. Prince William County Tax Administration Division 1st FL 1 County Complex Court Woodbridge VA 22192-9201.

Prince William County Virginia Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Prince William County Va Open Houses 133 Upcoming Zillow

Recently Sold Homes In Prince William County Va 29728 Transactions Zillow

Pwcs Calendar Form Template In Ms Word Doc Pdffiller

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements

2021 Real Estate Assessments Now Available Average Residential Increase Of 4 25 News Center

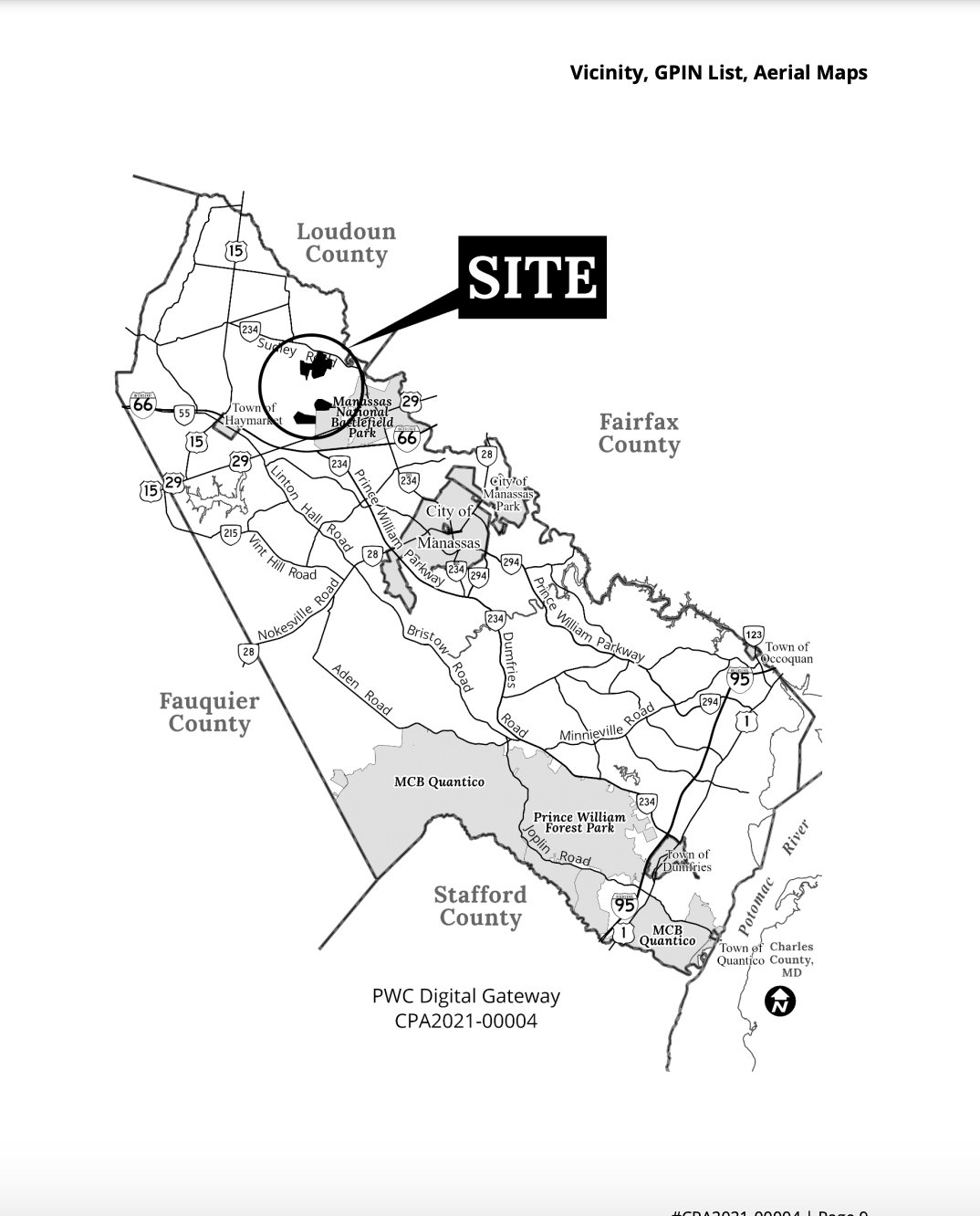

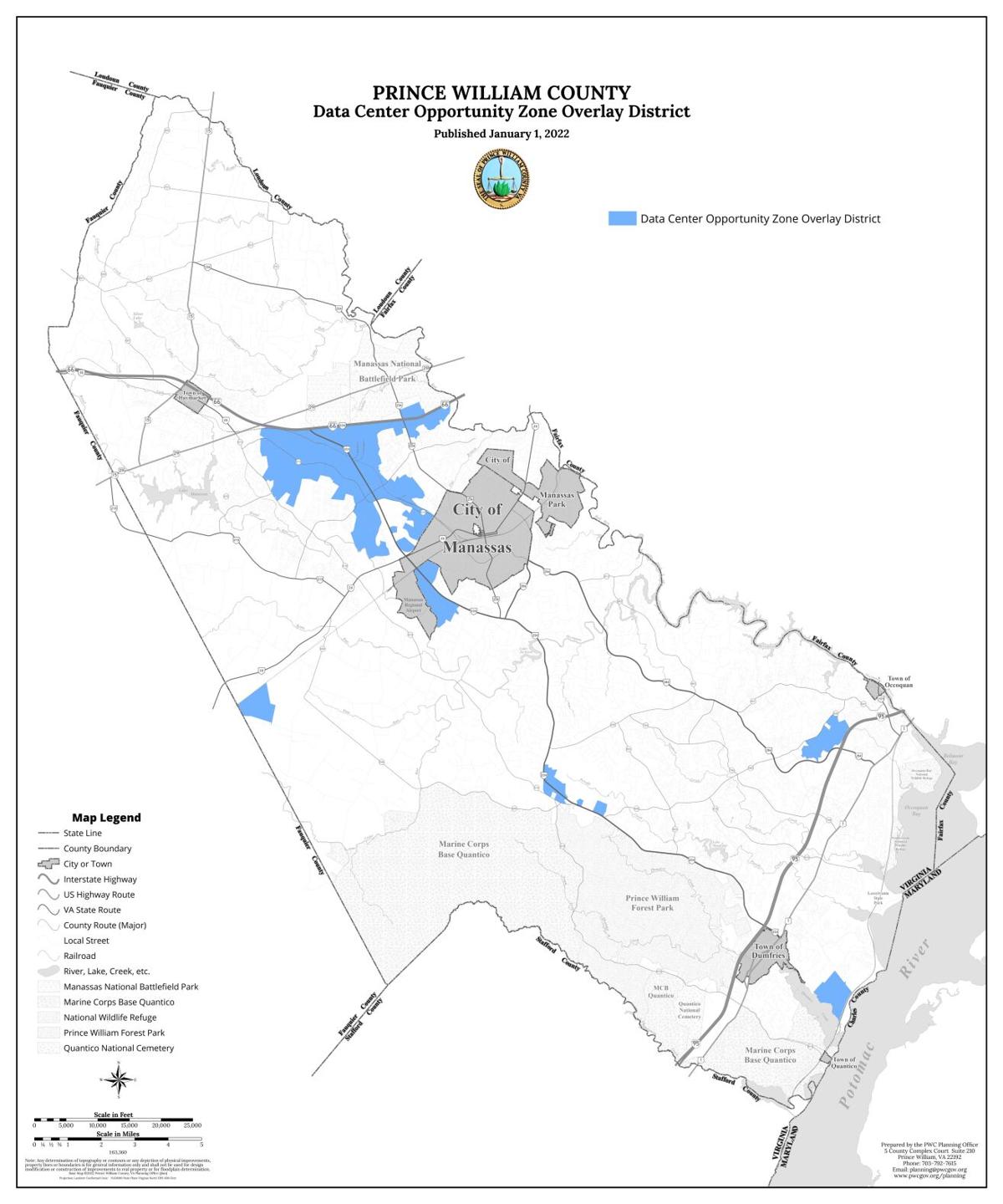

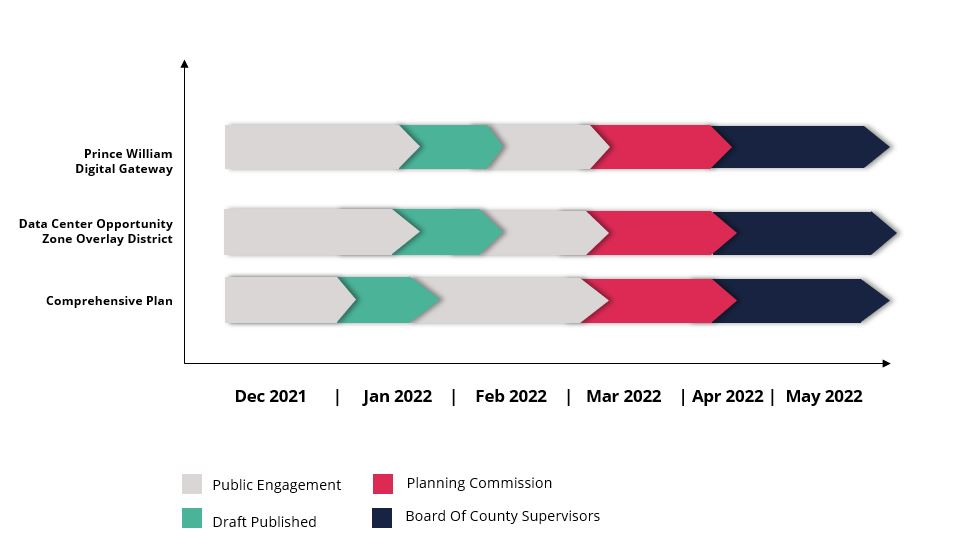

Prince William County To Formally Consider Data Centers Adjacent To Battlefield Bristow Beat

Prince William County Property Management Prince William County Property Managers Prince William County Va Property Management Companies

Prince William County Budget Set For Approval Residents Can Expect To See Tax Bills Tick Up Wtop News

Prince William County Virginia Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Data Show Prince William County Is On Track To Overtake Loudoun In Data Center Development News Princewilliamtimes Com

Report Rents Rapidly Increasing In Eastern Prince William News Princewilliamtimes Com

Manassas City Council Votes To Decrease Personal Property Tax Bills Prince William Living

Prince William County Va Businesses For Sale Bizbuysell

Prince William County Considers Land Use Changes That Encourage Sprawl The Piedmont Environmental Council

Prince William County Taxes Likely To Go Up Again Headlines Insidenova Com

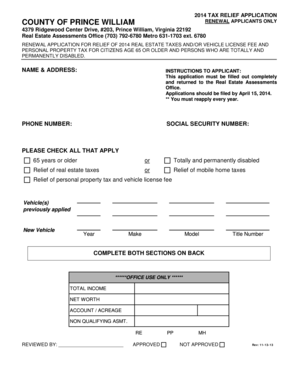

Fillable Online Pwcgov 4379 Ridgewood Center Drive 203 Prince William Virginia 22192 Pwcgov Fax Email Print Pdffiller